Bracebridge Capital emerges as top holder of ARKB and IBIT spot bitcoin ETFs

Quick Take

- Bracebridge Capital has emerged as the top holder of Ark Invest and BlackRock spot bitcoin ETFs.

- The hedge fund also reported owning shares in Grayscale’s GBTC, with its combined spot bitcoin ETF holdings valued at $434 million as of March 31.

Bracebridge Capital, a hedge fund that manages the endowments of Yale University and Princeton University, has reported owning shares in Ark Invest, BlackRock and Grayscale U.S. spot bitcoin exchange-traded funds.

In a 13F filing with the Securities and Exchange Commission on May 10, the Boston-based firm reported owning 4,327,380 shares in Ark Invest’s ARKB, 2,486,750 shares in BlackRock’s IBIT and 419,910 shares in Grayscale’s GBTC. The shares were valued at $307.2 million, $100.6 million and $26.5 million, respectively — as of March 31.

13F filings are quarterly reports filed with the SEC by institutional investment managers with at least $100 million in equity assets under management. The filings provide a view of the manager's stock holdings at the end of each quarter.

Bitcoin  BTC

+1.47%

was valued at around $71,200 on March 31, subsequently falling over 13% and currently trading for $61,834, according to The Block’s price page.

BTC

+1.47%

was valued at around $71,200 on March 31, subsequently falling over 13% and currently trading for $61,834, according to The Block’s price page.

Bloomberg ETF analyst Eric Balchunas noted that Bracebridge Capital was now the top owner of both Ark Invest and BlackRock’s spot bitcoin ETFs at their reported holdings’ more recent valuation. “The new high water mark (excluding authorized participants/market makers) for bitcoin ETF holdings has arrived. Boston-based Bracebridge Capital has reported owning $262 million of ARKB. It's also the biggest owner of IBIT too with $81 million in that ETF. They also own $20m of GBTC. They went wild basically,” Balchunas posted to X on Monday.

Bracebridge Capital’s ARKB holdings are ahead of Ark Invest’s own holdings of its spot bitcoin ETF via the firm's Next Generation Internet and Fintech Innovation funds, valued at $196.6 million, according to its fund pages.

US spot bitcoin ETFs now account for over 80% of Bracebridge Capital’s portfolio

Balchanus also noted that the U.S. spot bitcoin ETFs were now among Bracebridge Capital’s top portfolio holdings as of March 31. Ark Invest’s ARKB is the firm’s top holding — accounting for 61.1% of its portfolio — while BlackRock’s IBIT and Grayscale’s GBTC are its second and fourth largest holdings, representing 20% and 6.6%, respectively.

RELATED INDICES

The hedge fund also includes bitcoin miner Riot Platforms among its portfolio holdings, alongside other stocks such as Trump Media & Technology Group Corp.

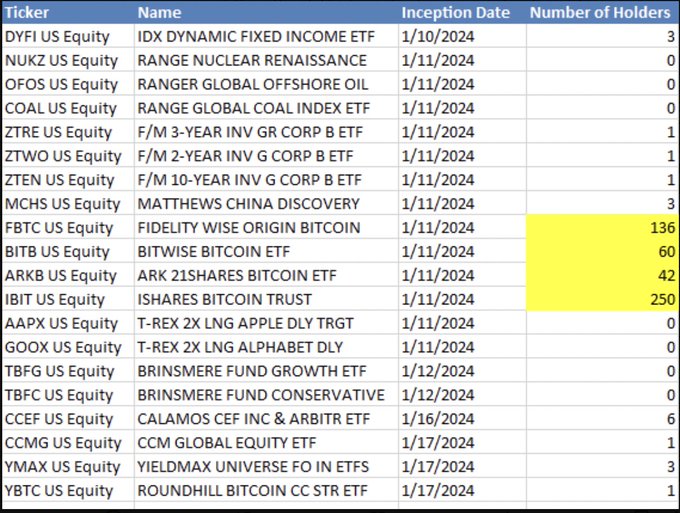

“What is also notable is the sheer number of holders that each has so far,” Balchunas added. “IBIT is up to 250. That's bonkers for the first quarter on the market. Here's comparison of the other ETFs launched the same week-ish as BTC ones. And we still have like a week of 13Fs to roll in yet.”

Holders of ETFs launched in January. Image: Eric Balchunas.

However, as one community member pointed out, 13F reports only require the disclosure of long positions in U.S. equities and options on equities. They do not require the disclosure of short positions, so they only provide a partial view of an investment manager's overall portfolio strategy.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.